Regency Mines (AIM:RGM) announced to the market an exploration update on its Lake Johnstone Greenstone Belt project (click here to view). We took this opportunity to ask Chairman Andrew Bell to expand on this for investors. Here's what he had to say:

MM: Could you expand a little on the significance of today's update on the exploration program at the Lake Johnstone Greenstone Belt.

AB: As can be seen from the aerial photographs showing the planned drill locations, these are working farms. There is cover over the whole area, with no rock exposure. It is therefore very different from a lot of the places we are used to exploring. Here, geophysics is the first tool, followed by geochemistry.

But that only gets you so far. Then you have to drill, and only then do you discover whether there is anything there or whether your geophysics has given you false positives – anomalies that are meaningless from our point of view, because they could come for example, in the case of our drilling, from salinity or siltstones.

So you don’t initially do a full drill programme, but drill short holes to find out how much cover there is over the rocks, and what rocks they are, as well as, naturally, what they contain.

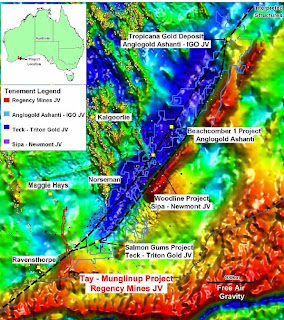

In this case we wanted to test the hypothesis in the south at target 1 that we had the jerdacuttup fault system, trending east-west, on which the Tropicana gold lies, and so the boundary between the yilgarn granites and the Albany-Fraser metamorphics to the south. In the north at targets 3 and (as an afterthought) 2 we wanted to test the hypothesis that the anomaly was in greenstone and potentially associated with nickel mineralisation.

At target 1 we encountered the geological boundary as hoped and in ten holes encountered sulphides associated with the Albany-Fraser migmatites, schists and shales.

At target 3 we encountered 1 km of greenstones under 30m of cover with some sulphides. The recent airborne geophysics that had hypothesised the extension of the greenstone belt under cover southward to this area seems validated.

So now we see what the samples tell us, and then we drill, we expect, more and deeper. Will there be something exceptional from these first phase 1 samples? Odds against. Will there be something worth pursuing? Reasonable odds. So far it looks promising and our geophysics and geology team can feel quite satisfied.

MM: You noted that the exploration programme successfully completed its objectives, encountering the geologies sought. Could you explain, in simple terms, what geologies were targeted, how these were encountered and how this helps demonstrate the potential mineralisation in the areas targeted?

AB: As stated above, Target 1 was an EM anomaly on a NE-SW strike, which is across elevation and the N-S strike of the greenstone belt. Tropicana 570k to the NE along the Yilgarn Craton margin has SE dipping mineralisation along a gneissic/schist contact. schists can provide this kind of moderately conductive and broad EM target, so as long as we were not picking up a paleaochannel or a siltstone stratigraphy, we were in with a chance. Anglogold to our east has a continuation of our anomaly.

The drill lines were designed to drill across any SE dipping structure. Target 3 was on a non-conductive magnetic ultramafic anomaly 7 km long. This all needs to be drilled to crystalline basement, but initial drilling was to test regolith for near surface disseminated cobalt/nickel mineralisation and to test margins for gold/copper.

Our geologist commented after conclusion of the drilling: “ if the assay results come back with strong mineralisation a new frontier will be opened up……………...

If mineralisation is weak, the geology remains robust and points to a new frontier with a mineralising system carrying sulphides otherwise not expected and that would put the discovery into the realms of jv consideration with a major”. Either way, i call this progress.

MM: How much has this work increased your confidence that the license area may host a gold deposit, particularly since referencing the similarities to the nearby Tropicana JV project, which appears to share a similar structural system?

AB: Anglogold, who own Tropicana, have pegged most of the geological boundary along the fault. The new understanding that comes from the Tropicana discovery has led to much excitement and a new exploration paradigm. All the ground is pegged, either by Anglogold, or by Teck, or by the Newmont JV. Except for what we have. We had it for the North-South greenstone belt not for the Tropicana-style potential, but in fact the boundaries of cratons are often fertile exploration ground. This is at the south of the yilgarn; for example, at the north boundary of the yilgarn there is another new exploration model, following Sandfire’s copper discovery at Degrussa.

We like also that our position is just west of the western junction of the two major East-West faults that bound the Albany-Fraser metamorphic zone – which mirrors the position of the Tropicana discovery, to the East of the eastern junction of these faults. Perhaps this is a coincidence, of course. But establishing that we have exactly the right rocks, and exactly the right geological boundary, running through our license is a great positive.

MM: Could you also expand a little on the significance of references to the proximity to Ravensthorpe site.

AB: The area is one known to host significant nickel deposits, of more than one type.

MM: Could you outline the next steps in the exploration program at Lake Johnstone.

AB: We will continue, we expect, with phase 2 drilling. If something exceptional appears, it may speed things up. We will also be looking to explore our very prospective area at Kambalda, an important nickel mining centre where we picked up an old mining license next to a producing mine.

MM: The price of nickel appears to be gaining strength. Do you see this as a continuing trend and if so how could this impact the economics of Regency's nickel projects going forward?

AB: Nickel is one of the most sensitive metals. It seems to over-correct in both directions. A year ago people were negative about platinum: the auto industry was on its knees, recovery would be slow, etc. Now people could hardly be more bullish, short and long-term.

Similarly a few months ago with nickel. No recovery in 2010; maybe a small recovery in 2011. How wrong they were. Chinese stainless steel demand is rising. Two thirds of nickel goes to stainless steel, which i call the middle class metal, because you use it in fridges and aircons and motorbikes and cars: everything an urban dweller uses. China will continue to see up to 25m new people joining the urban economy each year, and people continuing to save and buy consumer products in a highly aspirational society. Nor should the other highly populous developing societies of Asia and South America be ignored: they are following the same path.

Nickel will be a continuing bull market: I am convinced of it. The basic supply and demand situation is favourable, and we like this metal particularly and fashion will find us. When it comes to laterites and Mambare, we want to steal a march over other people by focussing on technology, so that we can be a leader. But shareholders already know what we are doing there. We will speak more of this soon, but we wanted shareholders to focus for a moment on what else we have. soon we will be encouraging them to focus on our nickel at Kambalda too.

MM: Finally how do you view the development potential of Lake Johnstone when compared with the company's lateritic nickel project at Mambare?

AB: The problem with sulphides is a different one: finding them! With laterites, like Mambare, we know they are there, and the problem is delineating, measuring, selecting the best zones, looking at the cobalt levels for potential credits, and finding suitable metallurgy. If we find nickel at Lake Johnstone, or quite possibly gold, it will be time to think of development potential.

Perhaps the issue will be overtaken by a gold discovery, and we will all be talking about the development potential of that.

Meanwhile, yes, the potential of Mambare is so large that it cannot easily be compared with anything else. We have to do more drilling to extend resource, and find the really high-grade pockets, and we have to advance on the corporate front.

Project Area and Structural Map graphics

http://www.rns-pdf.londonstockexchange.com/rns/7438J_2-2010-4-6.pdf

Maps of Magnetic Image

Target 1

http://www.rns-pdf.londonstockexchange.com/rns/7438J_3-2010-4-6.pdf

Target 2

http://www.rns-pdf.londonstockexchange.com/rns/7438J_4-2010-4-6.pdf

Target 3

http://www.rns-pdf.londonstockexchange.com/rns/7438J_5-2010-4-6.pdf

This summary represents the views and opinions of Miningmaven, has been prepared for information and educational purposes only and should not be considered as investment advice or a recommendation. All opinions expressed in this weblog are those of the author and should not be construed as being made on behalf of any featured Company.

Readers are advised to do their own extensive research before buying shares which, as with all small cap exploration stocks, should be viewed as high risk. Investors should also seek the advice of their investment adviser or stockbroker, as they deem appropriate.

All rights reserved. Users may print extracts of content from this blog for their own personal and non-commercial use only. Republication or redistribution of Miningmaven content, is expressly prohibited without the prior written consent of miningmaven. However, linking directly to the Miningmaven blog is permitted and encouraged.

Copyright © miningmaven 2010